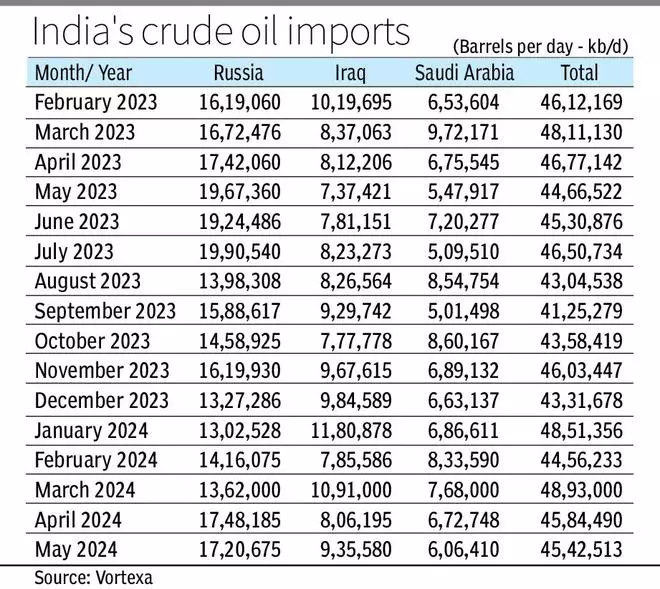

Indian refiners continued their purchase momentum for medium sour grades from its two largest trading partners, Russia and Iraq, during May 2024 as crude oil flows from another top supplier, Saudi Arabia, declined due to higher prices.

Analysts and trade sources indicated that price arbitrage favours Russia against Saudi Arabia by around $5 per barrel. The world’s largest crude oil exporter has been raising the official selling price (OSP) of its medium sour grade, Arab Light, to Asia for three consecutive months running into June as it attempts to tighten the oil market.

According to energy intelligence firm Vortexa, India imported higher volumes from Russia, Iraq, the UAE and the US last month compared to April 2024.

Russia still on top

Crude oil imports from Russia fell marginally to 1.72 mb/d in May 2024 (April: 1.75 mb/d) on a monthly basis, and by 13 per cent y-o-y. Ural shipments stood at 1.44 mb/d last month compared to 1.56 mb/d in April 2024.

Vortexa’s Head of APAC Analysis, Serena Huang told businessline, “Russia continues to be the top crude supplier for India in May. Whilst imports of Russian crude are down slightly in May compared to April, May’s volumes are still the second highest compared to last July.”

An official with a domestic refiner said that price is a major factor. Russian barrels continue to be more viable compared to Saudi Arabia. “Russia-India crude trade is one commercial opportunity both sides cannot ignore. Despite issues of payment and vessels, it has worked, which indicates the inherent value in it for both sides,” the official explained.

Also read: RIL to build global economic hub in Navi Mumbai

Huang pointed out that Russian crude will likely continue to be priced at a discount to Middle Eastern grades, given the importance of India and China as destination markets and the lack of alternative markets. Both public and private sector refiners continued their import momentum from Russia, albeit at a lower volume compared to April 2024.

Public refiners such as Indian Oil Corporation (IOC), Bharat Petroleum Corporation (BPCL) and Hindustan Petroleum Corporation (HPCL) imported 1.04 mb/d crude oil, marginally down from 1.05 mb/d in April 2024. However, imports on an annual basis were down 16 per cent.

Private refiners, Reliance Industries (RIL) and Rosneft-backed Nayara Energy, imported around 6,79,000 barrels b/d from Russia in May 2024 compared to 6,95,000 b/d in April. Shipments were down by 5 per cent y-o-y.

More crude from Iraq, US

Crude oil imports from Iraq rose by 16 per cent m-o-m and 27 per cent y-o-y to around 9,36,000 b/d. Similarly, imports from the UAE rose by 7 per cent m-o-m to 3,40,000 b/d. In May 2023, India imported around 1,90,000 b/d from the UAE. The FTA and Rupee trade settlement also helped improve volumes.

However, cargoes from Saudi Arabia fell by 10 per cent m-o-m to around 6,06,000 b/d. But, imports were higher by 11 per cent on an annual basis. “Meanwhile, with Middle Eastern crude supplies remaining tight, exporters such as Saudi Arabia have priced their medium-sour grades at higher OSPs compared to previous month, driving refiners to turn to Russian crude supplies where available,” Huang said.

Also read: At 120, City Union Bank changes tack, slightly

Crude oil shipments from the US rose by 7 per cent m-o-m to around 3,40,000 b/d. In May 2023, the imports stood at around 1,35,000 b/d. Trade sources said that imports were of light sweet grade due to weak market fundamentals amid refinery outages in Europe and the US lowered demand, which coupled with high supply availability, specifically from US exports, and better price arbitrage compared to West Asian grades.

Overall, India’s crude oil imports fell marginally to 4.54 mb/d in May 2024 (April: 4.58 mb/d), but were higher by 1.6 per cent on an annual basis.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.