The Budget is likely to propose an amendment in the Income Tax Act and Companies Act to ensure sovereign assurance till February 15, 2024 to companies and other stakeholders who may have purchased electoral bonds.

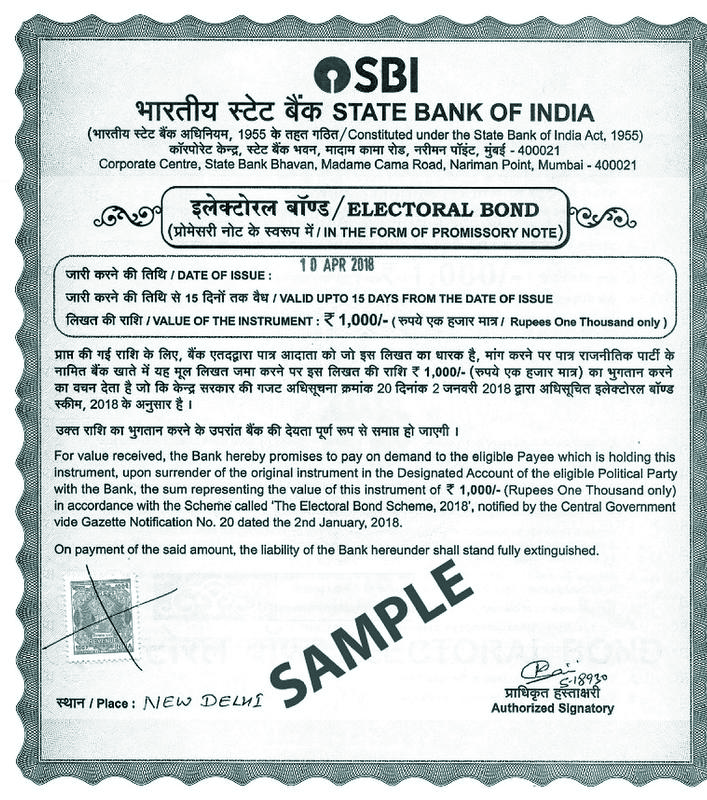

This is in the wake of the Supreme Court declaring electoral bond scheme and supporting amendments in various laws as ‘unconstitutional’.

Consequently, there are reports that some corporate buyers of electoral bonds received IT notices on deduction claimed on expenditure for these instruments.

Sources said Section 13A(b) of the I-Tax Act may be deleted, effective February 15, 2024, when the apex court scrapped the electoral bond scheme.

Additionally, changes to Section 182 of the Companies Act regarding contributions to political parties are possible. A proviso might also be added to Sections 80 GGB and 80 GGC of the I-Tax Act, which allow companies to deduct contributions to political parties.

IT notices

“Once the amendments enacted through the Finance Act are in place, they may provide clarity to the tax department and all stakeholders. Also, these will ensure sovereign assurance until the date of the apex court’s order,” a source said.

On February 15, the apex court held the electoral bond scheme as unconstitutional. Further, the court said that the deletion of the proviso to Section 182(1) of the Companies Act permitting unlimited corporate contributions to political parties is arbitrary and violative of Article 14.

Section 13 A of the Income Tax Act prescribes any income of a political party which is chargeable under the head “Income from house property” or “Income from other sources” or “Capital gains” or any income by way of voluntary contributions received by a political party from any person shall not be included in the total income of the previous year of such political party. Through the Finance Act 2017, additional conditions were added to facilitate the electoral bond scheme.

Accordingly, it was said that no donations of ₹2,000 or more should be received otherwise than by an account payee cheque, bank draft, use of electronic clearing system through a bank account or through electoral bonds. The section was amended to the effect that political parties shall not be required to furnish the names and addresses of donors who contribute via electoral bonds.

Since the names of donors have been made public, reports suggest notices have been issued to some of donors.