The outlook for the Indian economy remains bright, but increasing incidence of climate shocks imparts considerable uncertainty to the food inflation and overall inflation outlook, according to Reserve Bank of India (RBI).

The bright economic outlook is underpinned by a sustained strengthening of macroeconomic fundamentals, robust financial and corporate sectors and a resilient external sector, per RBI’s annual report for FY24.

The government’s continued thrust on capex while pursuing fiscal consolidation, and consumer and business optimism augur well for investment and consumption demand, it added.

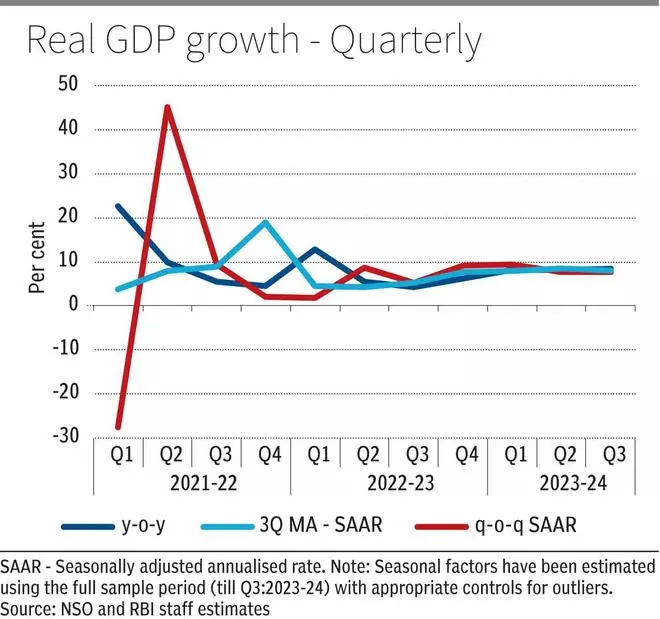

Real GDP growth for FY25 is projected at 7 per cent, with risks evenly balanced. The economy had expanded at a robust pace in FY24, with real GDP growth accelerating to 7.6 per cent from 7.0 per cent in the previous year – the third successive year of 7 per cent or above growth.

Even as the global economy is facing multiple challenges such as still elevated inflation, tight monetary and financial conditions, and escalating geopolitical tensions, the Indian economy is exhibiting strength and stability with robust macroeconomic fundamentals and financial stability.

“Geopolitical tensions, geoeconomic fragmentation, global financial market volatility, international commodity price movements and erratic weather developments pose downside risks to the growth outlook and upside risks to the inflation outlook.

“The Indian economy would also have to navigate the medium-term challenges posed by rapid adoption of AI/ML technologies and recurrent climate shocks. Even so, it is well placed to step-up its growth trajectory over the next decade in an environment of macroeconomic and financial stability...” RBI said.

The report noted that the prospects for agriculture and rural activity appear favourable due to the ebbing El Nino and the expected above normal southwest monsoon.

Referring to the headline inflation moderating by 1.3 percentage points on an annual average basis to 5.4 per cent in 2023-24, the report assessed that the easing of supply chain pressures, broad-based softening in core inflation and early indications of an above normal south-west monsoon augur well for the inflation outlook in 2024-25.

Climate shock shadow on food inflation

However, increasing incidence of climate shocks imparts considerable uncertainty to the food inflation and overall inflation outlook.

The central bank said low reservoir levels, especially in the southern states, and the outlook of above normal temperatures during the initial months of FY25 need close monitoring.

The volatility in international crude oil prices, the persisting geopolitical tensions and elevated global financial market volatility also pose upward risk to the inflation trajectory.

Taking into account these factors, RBI projected CPI inflation for FY25 at 4.5 per cent with risks evenly balanced.

The central bank emphasised that the budgeted reduction in gross market borrowings from 5.3 per cent of GDP in FY24 (Revised Estimated) to 4.3 per cent of GDP in FY25 (Budget Estimate) will enhance the flow of funds to the private sector and support private investment.

The fiscal outlook for states remains favourable, with adequate fiscal room to pursue increased capital expenditure.

The digitalisation of the tax system has enhanced tax collections, with the Centre’s direct tax revenues budgeted to reach 6.7 per cent of GDP in 2024-25, the highest in three decades.

On the financing side, the favourable outlook for domestic economic growth, easing of domestic inflation, and business-friendly policy reforms would be enabling factors in attracting foreign investment, both direct and portfolio.

Lenders’ asset quality

The report observed that capital and asset quality of banks and NBFCs remain healthy, supporting the growth in bank credit and domestic activity.

Pre-emptive regulatory measures aimed at curbing excessive consumer lending and bank lending to NBFCs, and investments in alternate investment funds (AIFs) are expected to contain the build-up of potential stress in balance sheets of financial intermediaries and contribute to financial stability.

“While domestic banks and NBFCs have exhibited resilience amidst global uncertainties, recent events underscore the importance of vigilant risk management.

“Considering the dynamic nature of the interest rate risk, banks may have to address both trading and banking book risks, especially in the light of moderating NIM (net interest margin),” RBI said.

On the liabilities side, the cental bank underscored that it is imperative to focus on diversification of deposit sources as reliance on bulk deposits heightens sensitivity to interest rate fluctuations.

FY25: Expected measures

Among the measures the regulatory and supervisory measures that RBI plans to undertake in FY25 to further strengthen financial intermediaries will include a comprehensive review of the extant IRACP (Income Recognition, Asset Classification and Provisioning) norms and the prudential framework for resolution of stressed assets; harmonised set of prudential guidelines for all lenders undertaking project finance; a comprehensive review of the extant regulatory instructions on interest rates on advances.

Further, the central bank will get lenders to move towards adopting a forward-looking expected credit loss approach; and issue Securitisation of Stressed Assets Framework.

RBI said a risk-based authentication mechanism, as an alternative to SMS-based one-time password (OTP) for additional factor of authentication (AFA), would be effectuated to address risks in payments.

During FY25, the Reserve Bank would also review the priority sector lending guidelines.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.