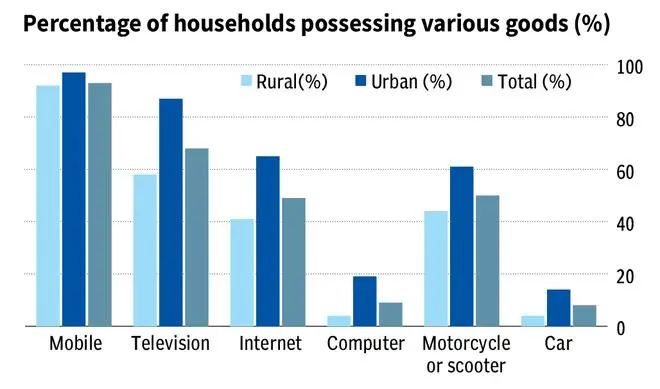

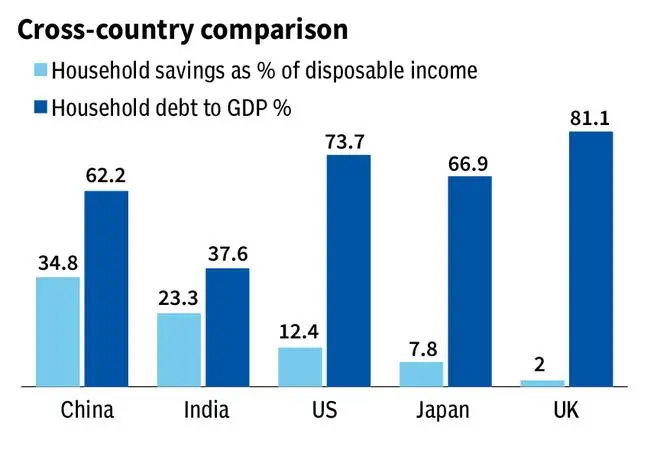

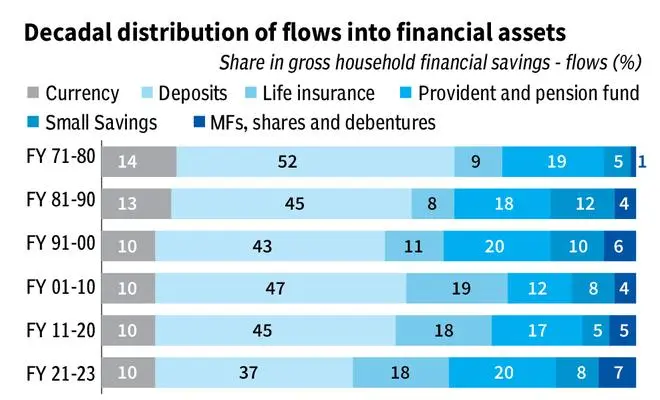

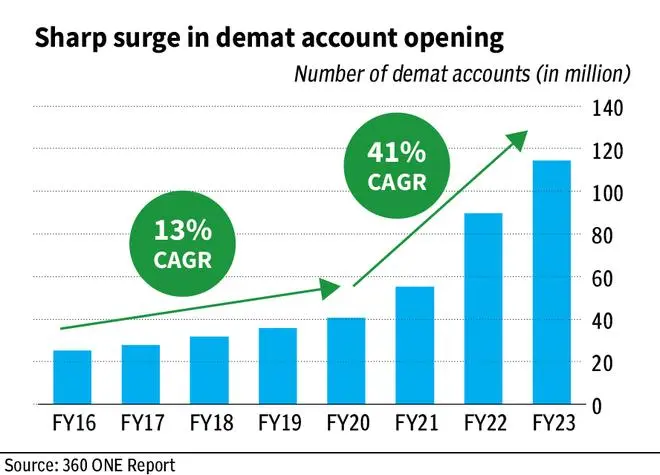

A report on financials of Indian households has provided some interesting insights. While the availability of mobile phones is ubiquitous across India, less than 10% of households possess cars. The savings rate of Indian households is noticeably higher than those in many developed countries. India’s debt-to-GDP ratio is significantly lower than that of many developed countries, thus not posing any systemic risks. While the share of deposits in financial savings has decreased steadily, that of life insurance and equities have increased. The rapid surge in demat accounts points to higher equity holdings in the future.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.