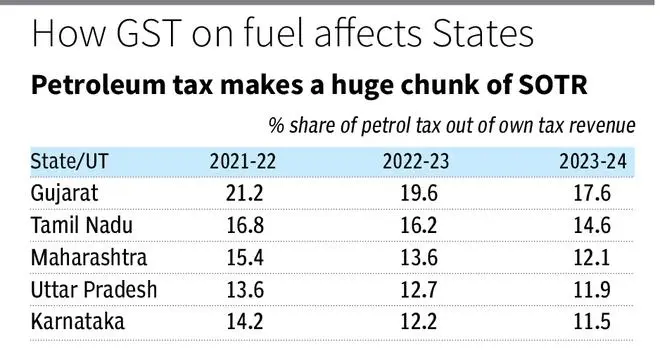

Even as the Centre mulls levying Goods and Services Tax (GST) on petrol, diesel and Aviation Turbine Fuel, data show that States earn significant tax revenue from petroleum, which makes up close to one-fifth of own tax revenue in case of some States.

Tax on petroleum makes up 11-17 per cent of the States’ own tax revenue of the top five States in FY24, as per analysis of data from the Petroleum Planning and Analysis Cell (PPAC) and Comptroller and Auditor General of India (CAG). Even in the previous years of FY23, FY22, and FY21, the share of petrol tax stood at similar proportion.

Gujarat, Tamil Nadu, and Maharashtra have the highest share of tax revenue generated from petroleum in FY24 relative to their total own tax revenue at 17.6 per cent, 14.6 per cent and 12.1 per cent, respectively.

Oil Minister Hardeep Singh Puri recently remarked about the Centre’s plans to levy GST on petrol and other fuels, but analysts note that this could pose a challenge for States as they are heavily reliant on this tax revenue due to the inelastic nature of fuel demand.

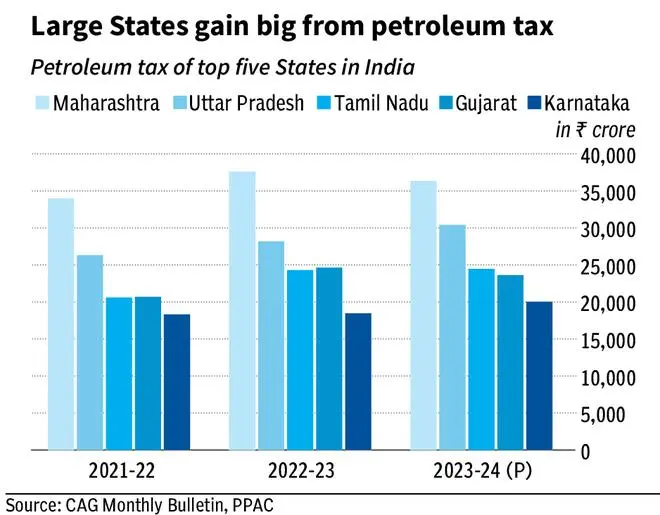

Fuel prices are calculated based on several indicators such as the base price of crude oil, excise duty, dealer’s commission and charges and value added tax (VAT) and it varies across States. In 2023-24, Maharashtra, Uttar Pradesh (UP) and Tamil Nadu led the tally in tax revenue from petroleum with collections of ₹36,359 crore, ₹30,411 crore and ₹24,470 crore, respectively, as per PPAC’s provisional data.

Significant hurdles

“While bringing petrol and diesel under GST could streamline the tax system and reduce fuel costs, it poses a significant challenge for States heavily reliant on fuel tax revenues. Effective strategies and negotiations will be crucial to managing the transition and ensuring fiscal stability” Krishan Arora, partner, Grant Thornton Bharat said. States may seek a larger share of central government transfers or grants as an interim relief measure until State revenues stabilise, he added.

Maharashtra’s tax revenue from petroleum increased from ₹27,190 crore in 2018-19 to ₹36,359 crore in 2023-24 (P), registering a 34 per cent growth. Similarly, UP’s tax revenue on petroleum grew from ₹19,167 crore to ₹30,411 crore during the same period, recording a 59 per cent growth.

The overall tax revenue growth from petroleum products for all Indian States has seen a significant rise over the past decade. In 2014-15, States collectively collected ₹1.37-lakh crore from petroleum taxes, which increased to ₹2.92-lakh crore in 2023-24, a CAGR of roughly 8 per cent over the 10-year period.

While excise duty on petroleum products is uniform nationwide, States impose their own VAT, leading to significant variations in prices. Telangana imposes the highest VAT on petrol at 35 per cent, followed by Andhra Pradesh at 31 per cent.

When GST was introduced, the government passed the GST (Compensation to States) Act 2017, whereby the Centre would compensate States for their loss of revenue and a GST compensation cess was used to fund this. The cess was subsequently extended until March 31, 2026. To levy GST on petrol, diesel and ATF, the Ministry of Petroleum and Natural Gas will have to pass a recommendation to the Finance Ministry, which will then be taken forward to the GST Council to implement the changes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.