Hyundai Motor India (HMI), a 100 per cent subsidiary of South Korea-based global auto giant Hyundai Motor Company, filed its draft red herring prospectus (DRHP) last week. As per media reports, the IPO size could be around $3 billion, with Hyundai Motor India being valued at as high as ₹25 billion. The IPO is planned some time in the second half of 2024, and if successfully concluded, it will be India’s largest IPO as things stand now.

One interesting takeaway that we gleaned from the DRHP was how HMI has ridden the premiumisation trend in India in recent years. Between Fiscal 2019 and Fiscal 2024, there has been a remarkable shift in what modern Indian consumers prefer when it comes to their vehicles. Here are a few charts capturing this trend and also how HMI compares with its parent company.

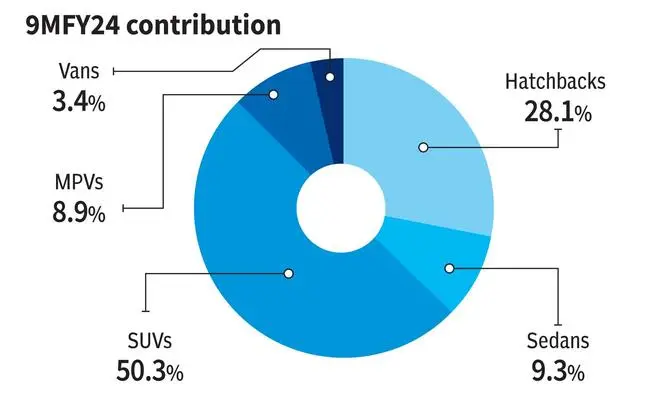

While HMI original took off in India with launch of its Hatchback - Santro (and later Santro Xing), nearly three decades back, today hatchbacks represent less than 30 per cent of its overall sales.

SUVs today account for 50 per cent of sales versus less than 25 per cent, five years back.

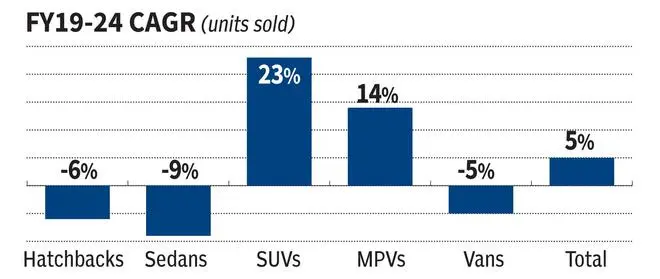

SUVs and MPVs have been only drivers of growth in recent years

With the current trends of premiumisation, the ASP of the vehicles has increased at a CAGR of 7-8%, reflecting the shift towards higher-end models.

Today HMI’s units sold represent just a little less than 15 per cent of parent company’s total sales volume

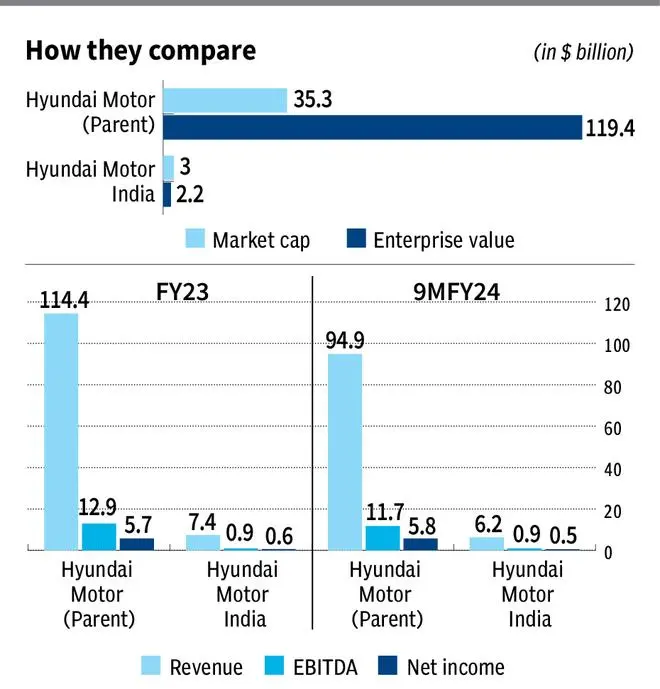

In terms of revenue share, HMI’s sales are at 6.5 per cent of the parent company’s consolidated sales while EBITDA and net profits are in the range of 6.5-10 per cent.

Nevertheless, HMI commands a substantial premium in valuation as compared to its parent company. With media reports mentioning a market capitalisation of ₹25 billion for HMI at the upper end, its enterprise value would represent 20 per cent of the parent company’s current value.

The author is an intern with bl.portfolio

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.