Boosted by record transfer from the Reserve Bank of India (RBI) and helped by the Model Code of Conduct, the Centre achieved the unique distinction of a monthly fiscal surplus in May after a gap of 22 months.

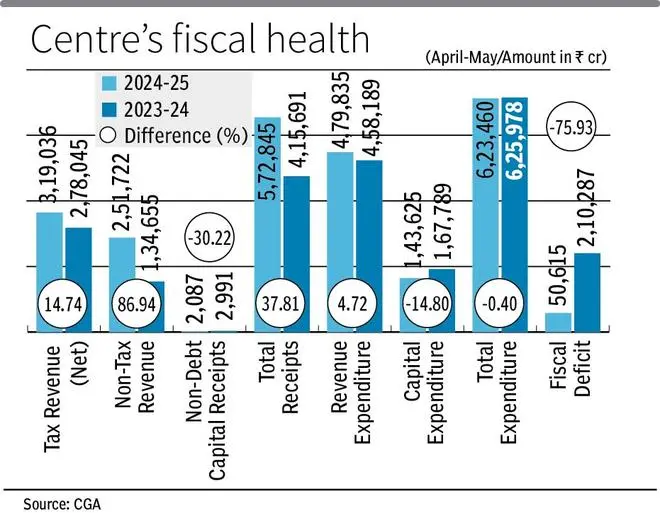

With this, the fiscal deficit during the first two months has come down to just 3 per cent of the Budget Estimate (BE) against 11.8 per cent during the corresponding period of the last fiscal.

Fiscal surplus or deficit is the gap between expenditure and income of the government.

The latest print has boosted the prospect of lowering the fiscal deficit in the full Budget, likely to be tabled during the third week of July. The interim budget, presented on February 1, has projected a fiscal deficit of ₹16.86-lakh crore or 5.1 per cent of GDP (Gross Domestic Products). The government aims to achieve fiscal deficit of 4.5 per cent by the end of next fiscal year i.e., 2025-26.

According to data made public by Controller General of Accounts (CGA), the official book keeper of Central Government, the government got over ₹3.59-lakh crore in May along with a major contribution of ₹2.1-lakh crore from RBI. However, total expenditure was around ₹2-lakh crore mainly on account of Model Code of Conduct affecting government spending. Still, surplus was around ₹1.6-lakh crore.

Data also revealed that in two months period (Aprll-May), net tax revenue was ₹3.19-lakh crore or 12.3 per cent of BE 2024-25. In the corresponding period, it was 11.9 per cent of BE 2023-24. Total expenditure at May-end 2024 was ₹6.23-lakh crore or 13.1 per cent of this fiscal BE. In the year-ago period, it was 13.9 per cent of BE.

Devendra Kumar Pant, Chief Economist with India Ratings & Research (Ind-Ra), said capex was at six-month low of ₹44,390 crore. While the benefit of higher dividend from RBI will not be repeated in rest of the fiscal, the capital outlays/capex are unlikely to grow faster in June and may get a boost from policy continuity mainly post the Budget presentation.

Aditi Nayar, Chief Economist with ICRA, said the revenue upside seen from non-tax, and to a smaller extent, tax receipts suggests headroom to both boost expenditure and “target a faster fiscal consolidation than what was penciled in to the Interim Budget for FY2025.”

“Ind-Ra expects the government while presenting FY25 full Budget is likely to assume a nominal GDP growth of more than 11 per cent. The growth momentum of last three fiscals is expected to continue in FY25 also, this along with revenue buoyancy may lead fiscal deficit of Union Government to be 4.9 per cent of GDP,” Pant concluded.

Core sector growth

The eight key infrastructure sectors’ growth rose by 6.3 per cent in May on healthy expansion in the production of coal, natural gas, and electricity, according to official data released on Friday. The production of the eight sectors grew 6.7 per cent in April. The growth of these core sectors — coal, crude oil, natural gas, refinery products, fertiliser, steel, cement and electricity — was 5.2 per cent in May 2023.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.