India Cements is in the news recently as industry leader UltraTech Cement has made a financial investment in the company by acquiring 23 per cent of the stake. India Cements as a company has faced volatile operations last two years owing to liquidity constraints and has initiated a course correction plan for FY25-26.

At this juncture, a financial and non-controlling stake purchase by a larger and profitable operator has raised several questions. The stock has gained 30 per cent in the last week and is trading at a premium valuation of 15 times FY26 EV/EBITDA, which is comparable to large cement operators. We recommend that investors hold on to India Cements stake as financial, management and strategic outlook bears a positive bias despite a non-definitive outlook.

Operational headwinds

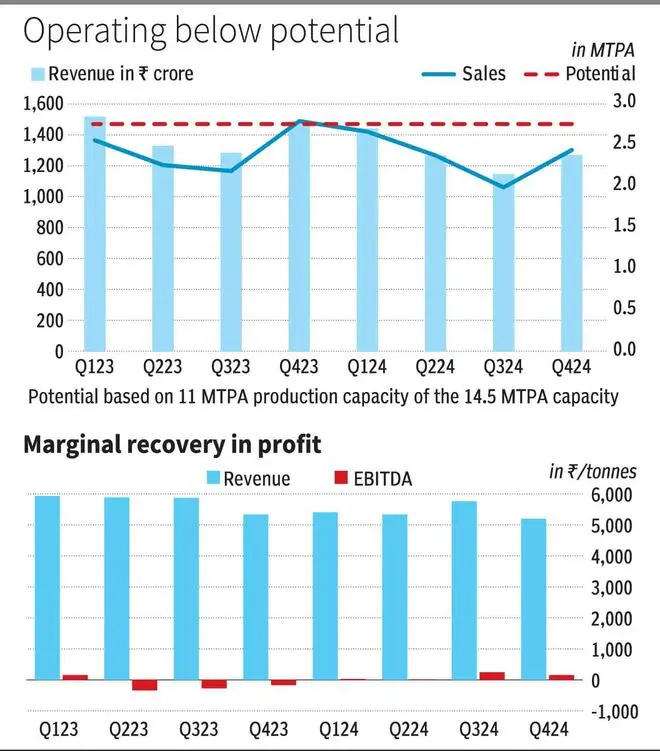

On a consolidated basis, India Cements reported a blended EBITDA per tonne of ₹105 in FY24, recovering from the loss of ₹146 per tonne in FY23. While this may seem positive, the company usually reported an EBITDA per tonne of ₹900-1000 per tonne as recently as FY20-21. Lower utilisation, higher cost of production compared to realisations were cited as the main reasons for the decline.

The capacity utilisation recovered from 53 per cent in Q3FY24 to 61 per cent in Q4FY24, which is also lower than the 75 per cent India Cements operated earlier in FY20-21. Compared to 11 mtpa per annum potential production that can be expected, the company delivered only 9.5 mtpa in FY24. The loss of operating leverage in a commoditised sector has impacted the margin performance for India Cements.

The company has been constrained by limited working capital credit lines restricting it to lower volumes. Older plants with a higher power requirement, stretched creditors, loss of market share and high debt burden have impacted the company’s ability to raise additional working capital.

Path to recovery

The company is disposing non-core assets to shore up working capital. It recently sold a grinding unit with low margins for ₹315 crore and has done smaller land sales to fund working capital and also raise capital for upcoming capex.

It has earmarked ₹500 crore for efficiency-building capex. This includes a a waste heat recovery system at one plant, 1 mtpa fly ash extension at Sankari plant and plans for Raasi plant group. The company expects to generate cost savings of ₹150-175 per tonne with the plans by FY26 and additional sales volume.

On the commodity cost front, power and logistics costs have come off their highs in FY24 by 22 per cent and 9 per cent YoY. Even as realisations may face headwinds in southern markets from overcapacity, post-election and post-monsoon pricing may creep upwards. The company can look to a period of better realisations and lower cost of production in FY25, if coal and transportation costs hold at the current level.

Higher utilisation supported by higher working capital availability, efficiency programme and favourable commodity prices should point to improvement from the current low margin performance for India Cements.

UltraTech investment

The 23 per cent stake purchase will not trigger an open offer as per SEBI’s acquisition rules. Even UltraTech Cement has called it a non-controlling financial investment. The acquisition price comes out to $90 per tonne for the 14.5 mtpa capacity, which is comparable to mid-size deals done in the recent past. UltraTech acquired Kesoram Cements at $80 per tonne (10.8 mtpa capacity based in South and Western markets. Ambuja Cements most recently acquired a South based player, Penna Cements, with 14 mtpa capacity at $89 per tonne.

India Cements is largely focused on South India — 5 mtpa in Telangana, 6 mtpa in Tamil Nadu, 2.1 mtpa in AP, and 1.5 mtpa in Rajasthan. This should complement UltraTech Cement, which at present only has 15 per cent exposure to the southern region, if it can strike a deal with India Cements promoters.

Investor attention, which drove the outsized gains of 30 per cent this week, is also focussed on the shareholding pattern of India Cements.

India Cements has a significant public shareholding and is yet to post strong profits in the last two years. The promoters hold 28.42 per cent of which 46.2 per cent is pledged. Apart from UltraTech Cement, other public shareholders hold 48 per cent of shareholding. Even with a financial investment which is non-controlling, Ultratech Cement’s significant stake will drive speculative interest, which can support the stock price above its intrinsic value in the medium term. Given scope for strategic developments, investors can continue to hold the shares.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.