Central Bank Digital Currency (CBDC) is a major revolution in the world of fintech and e-Rupee is rapidly expanding its footprint. Acknowledging the meteoric rise of UPI usage, the RBI Governor stated at Bank of International Settlement’s “Innovation Summit 2024” that there exists considerable scope for further digitalisation of payments in India, and e-Rupee provides an added avenue by mimicking features of cash in the virtual world, — anonymity, ease of usage and finality of settlement.

The initial interest in CBDC was to create a strong counter to cryptocurrency and its various forms.

Today, CBDCs present a bouquet of advantages for the participating countries, which include: offering offline functionality and programmability, supporting last-mile targeted fiscal transfers, enabling cross border payments, and ‘finality of settlement’ feature substantially reducing the cost of transactions.

Not surprisingly, exploring CBDC pilots on cross-border payments is a priority for RBI’s FinTech Department in FY 2024-25.

In India, wholesale CBDC [CBDC-W] (for settling secondary market transactions in government securities and interbank lending and borrowing operations) pre-dates the retail variant [CBDC-R] (covering P2P and P2M transactions). But their volumes in circulation have undergone a shift, and thereby hangs a tale.

Retail surge

Per Schedule 5 to RBI’s Balance Sheet and Income Statement a la Annual Report for 2023-24, CBDC-R has zoomed from ₹5.7 crore in 2022-23 to ₹234.04 crore in 2023-24, whereas CBDC-W has dipped from ₹10.69 crore in 2022-23 to ₹0.08 crore in 2023-24. So CBDC is gaining traction in the retail segment.

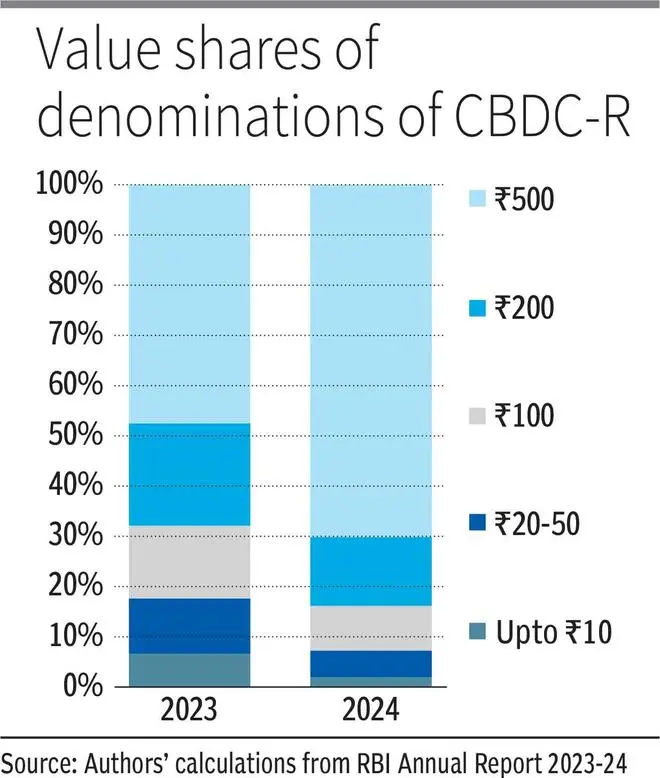

Even the denominational composition of CBDC-R suggests so. Between 2023 and 2024, the share in value of lower denomination CBDC-R (viz. all denominations below ₹500) has shrunk, whereas that of the ₹500 denomination CBDC-R has risen concomitantly (see graph), closely mirroring the share of physical banknotes in circulation. CBDC seems to be transitioning from the umbra to the penumbra regions in digital payment transactions and will soon be out in the light!

e-Rupee and UPI continue to witness vibrant developments. CBDC-W has been expanded in its scope to cover more transactions between financial institutions; CBDC-R has been expanded to more participating banks and locations, and made interoperable with UPI QR codes.

Reports suggest that programmability and offline functionality are being tested in CBDC-R.

Simultaneously, the RBI has taken keen interest in the tech and policy developments regarding UPI by supporting addition of new features to enrich product offering; conversational payments have been enabled in UPI; offline transactions using NFC (near field communication) technology were enabled in UPI Lite on-device wallet; transfer to/from pre-sanctioned credit lines at banks have been enabled in UPI; per transaction limit for UPI payments to hospitals and educational institutions has been enhanced from ₹1 lakh to ₹5 lakh; interoperability of UPI has been achieved between India and the UAE, Mauritius, Sri Lanka, Nepal. The RBI is planning to expand UPI to 20 countries by 2028-29.

However, there are a few ponderables. About 86 per cent of the UPI transactions are dominated by two entities, each of them having more than the 30 per cent cap brought in by NPCI in 2022.

Two, since UPI transactions are free-of-cost and do not charge any MDR (merchant discount rate), appetite for new players to enter the UPI space is limited. Users have been accustomed to a free UPI, though a small fee is now levied on some PPI (prepaid payment instruments) payments. This has not affected its popularity, but it may spur competition amongst UPI players. While competition is mostly beneficial, the margins at stake here are already wafer-thin.

Advantage CBDC

Even with a near-ubiquitous UPI, CBDC — viewed as complementary to UPI — is desirable.

While UPI needs operational bank accounts, CBDC can ride on a wallet powered by a mobile number.

In regions with low banking penetration, CBDC provides succour. While UPI bank account money is backed by deposit insurance, CBDC enjoys sovereign guarantee. CBDC development and usage will be highly instrumental in reducing cash usage.

We witness today a “Currency Paradox” — a rise in UPI transactions without a significant decrease in cash usage. People prefer to use digital payments for daily transactions, while keeping cash as a fall-back and for precautionary purposes. With CBDC, RBI can ‘nudge’ people for holding less cash and/or ‘penalise’ people for holding physical cash.

Strategically, CBDC can be posited as a viable alternative to UPI and act as a fall back option in case UPI ecosystem encounters unfavourable churning.

It is clear that the RBI prefers to adopt a posture of “constructive ambiguity” on matters pertaining to CBDC. As a fast-payments mode, CBDC is a priority for RBI qua honouring consumer sovereignty and expanding the basket of products for a rapidly digitising and less-cash using society to choose from.

We now need to ensure the highest degree of UPI-interoperability and a robust grievance redressal mechanism to break the inertia of new users towards CBDC. RBI may like to consider exploring options to introduce CBDC operations through feature-phones, particularly offline functionalities, through the HARBINGER hackathon.

CBDC pilots may also test the feasibility of banks and non-banks offering CBDC wallets for value-added services, to further the quintessential ‘created by RBI, distributed by banks’ design feature of CBDCs.

The technology-based and legislation-induced options to anonymity in CBDCs may be discussed with a wider set of stakeholders, so that all possible implications are duly incorporated in the deliberations.

The writers are officers of the Indian Economic Service. Views expressed are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.