Born in 1997, I slid into the world during India’s vibrant post-liberalisation era. Fast forward to my teenage years in the late 2000s, and while the rest of the world’s fever about the new millennium had got a bit of a hangover, India still had her dancing shoes on, especially in the financial sector. I mean, markets were popping, foreign culture was as tempting as the latest Bollywood hit, and consumerism? It was like India’s newest pop sensation.

The middle class was having its moment, strutting around with new confidence. Everyone was flaunting the latest ‘must-haves’. Sure, the world has always had its VIPs and the ‘Still waiting for my invite’ groups. But it felt like the middle-class was finally getting a backstage pass to all the world’s good things.

Speaking of VIPs, my dad seemed to have a bit of a magic touch. As kids, whenever we had a wish (that didn’t include unicorns), it felt like dad had a make-a-wish hotline. And his secret weapon? The EMI (equated monthly instalment). A small hatchback, a scooter, a house, all our wishes were granted with ease.

Little did we know, while we imagined living in a fairy-tale castle, we were actually in a house of cards... of EMIs. I think dad himself forgot that he didn’t have the money that he was spending; a car, a house and other material objects gave him the illusion that he was also well-to-do. Post-2008, our cash registers sang crickets. And amidst all this, our family script took another twist: my parents’ divorce in 2012.

Like many Indian families that go through divorce, mom and I also took refuge at grandma’s home, which eventually turned out to be a life-changing experience. Think of it as a crash course in “Extreme Saving 101”. Toothpaste tubes? They weren’t done till they squeaked in protest. That thriftiness was a culture shock.

During one of our evening teas, my grandmother asked: “Do you know the difference between debt and debit? Just an I.” I was floored — since when did grandma start taking shots at dad and cracking puns? But as I grew older, I realised grandma wasn’t aiming for laughs by being snarky. She was dishing out a life lesson with a slice of humour. Her lesson was that you dictate your own fate; your finances are your responsibility.

My grandmother’s attitude towards EMIs was unique as well. For her, an EMI stood for — Eventual Monetary Insolvency. The difference in my grandmother’s attitude versus my father’s attitude to EMI was stark! It made me realise that while an EMI could stand as a symbol of empowering individuals to some, it also could stand as a symbol of financial irresponsibility to others.

People are heavily influenced by the culture around them — My grandma grew up in an era where she saw the birth of a new nation — India. This means, she also saw very hard times and thus understood the importance of savings. My dad, however, was in his 20s when he saw liberalisation. He saw markets open up, and he saw optimism around him, and thus, he made the decisions that he did. The culture around both of them shaped their perception of many things.

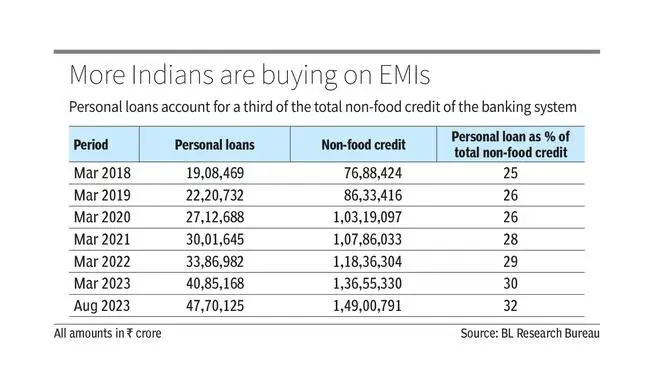

The culture of today’s India also encourages consumerism. And EMIs are an effective tool to enable that consumption. But when not used wisely, it can make you feel like a hamster on a wheel, trapped and pulled back by debts, always running behind to make payments.

My dad saw EMI as a helpful friend. My grandma never believed in taking money from her friends. I, on the other hand, consider EMI as an acquaintance — We meet when needed, but I’d like to keep my distance from it. If my finances do not instantly meet my aspirations, I may also feel like a hamster chasing behind a dream, but I’m okay with it as long as I’m not trapped by the EMI wheel.

(Hamsini Shivakumar is a Semiotician and founder of Leapfrog Strategy. Prabhjot Singh Gambhir is a senior research analyst at Leapfrog Strategy.)

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.