SIPs (systematic investment plans) are setting new records each month with monthly SIP inflows exceeding ₹19,000 crore this March.

The virtue of investing without a break for the long term, to earn strong risk-adjusted returns, has caught on with retail investors.

Even so, selecting the right funds for your monthly SIP investments isn’t that easy a task.

That’s why we put over a 100 diversified equity funds from large-cap, mid-cap, small-cap, large & mid-cap, flexi-cap and multi-cap categories under the scanner to identify the best funds for systematic investing.

We took the 10-year SIP returns (XIRR) for these funds (direct plan alone) and also those of their respective benchmarks to understand the funds that went past the indices with their performance. A 10-year period is reasonably long enough to gauge the SIP performance of funds.

Less than half the funds (44 out of 97 schemes) managed to beat standard benchmark indices on SIP mode. This means choosing the best of funds must be done carefully.

The set of funds that managed to beat their benchmarks on SIPs were further put through the wringer in terms of rolling returns and consistency of performance.

With the resultant set of funds that made the cut with both SIP and rolling returns consistency, we give you a bunch of schemes that are well worth your investments for the long term.

One point to note here is that some of these funds may have had different mandates before 2017-18 when SEBI’s regulations on categorisation were implemented. But we go by the current category status.

There are also some cases of management changes as well.

Read on for more on each of the diversified fund categories and the overall star performers’ list.

Large-cap performers

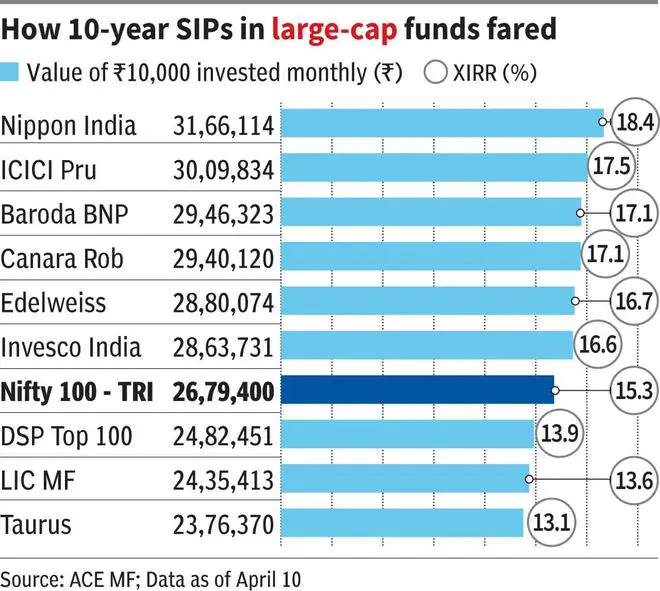

For the large-cap category, the Nifty 100 TRI is taken as the common benchmark for all the schemes. Some may have other benchmarks such as Nifty 50 TRI, S&P BSE 100 TRI and so on, but on the whole, Nifty 100 TRI is representative enough of the space.

As many as 14 of the 24 large-cap funds with 10-plus years track record have managed to beat the Nifty 100 TRI, which delivered 15.34 per cent returns (XIRR) over this period.

Among the schemes that did well, the top five with 16.69-18.44 per cent returns from SIPs are Nippon India Large Cap, ICICI Prudential Bluechip, Baroda BNP Paribas Large Cap, Canara Robeco Bluechip Equity and Edelweiss Large Cap.

Among the ones that lost out with underwhelming performance over the 10-year period, recording much lower returns than the Nifty 100 TRI, are Taurus Large Cap, LIC MF Large Cap, DSP Top 100 Equity, Franklin India Bluechip and PGIM India Large Cap.

Lackadaisical mid-caps

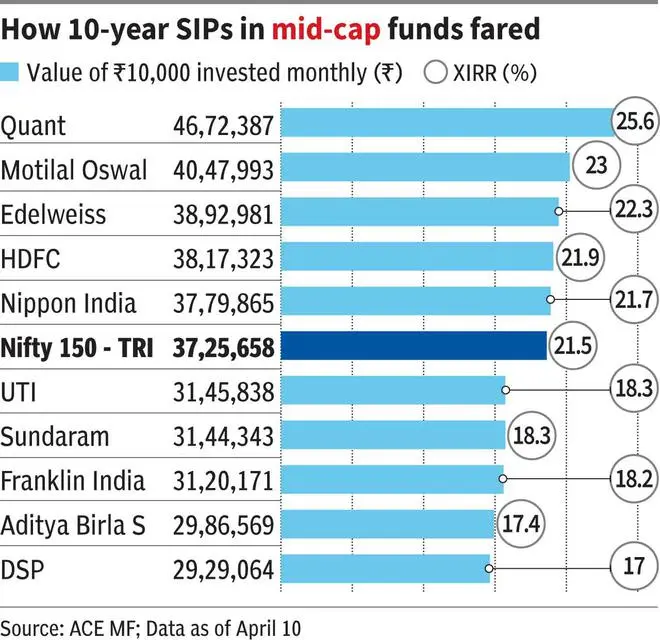

In the last 10 years, SIPs in mid-caps did not turn out to be that rewarding. Of the 21 funds in the category with a long-term track record, only five exceeded the returns of the Nifty Midcap 150 TRI in terms of SIP returns.

Though some funds have the S&P BSE Midcap 150 TRI or other midcap indices as benchmarks, we have stuck to the Nifty Midcap 150 TRI as the common benchmark.

Quant Midcap, Motilal Oswal Midcap, Edelweiss Midcap, HDFC Midcap Opportunities and Nippon India Growth were the outperformers.

Those with lukewarm performance well below the Nifty Midcap 150 TRI SIP returns (XIRR) of 21.46 per cent were DSP Midcap, Aditya Birla Sun Life Midcap, Franklin India Prima, Sundaram Midcap and UTI Midcap, among many others.

Small-caps sizzle

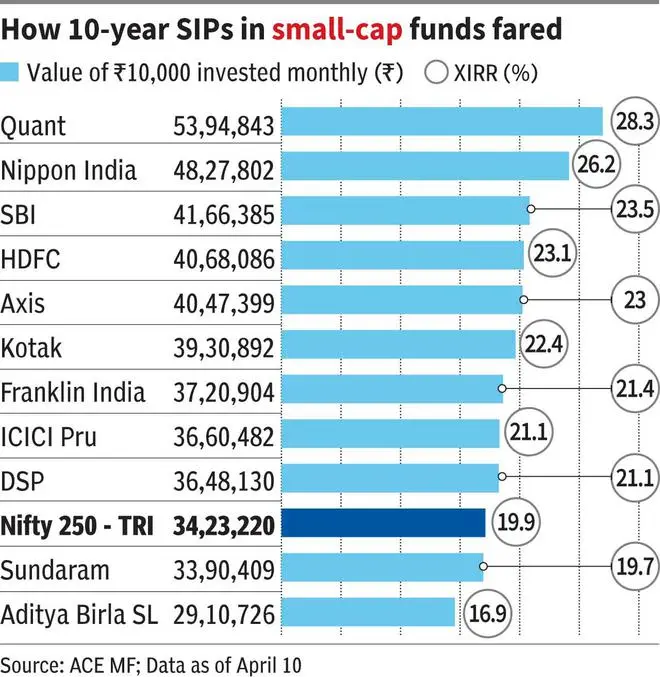

This is the segment that has received considerable attention in recent times, thanks to heavy investor interest and SEBI’s concerns.

Of the 12 small cap funds, as many as 10 have exceeded the benchmark Nifty Small Cap 250 TRI’s SIP returns of 19.89 per cent over a 10-year period.

Small-cap funds from the houses of Quant, Nippon India, SBI, HDFC, Axis and Kotak performed well and exceeded the index’s returns.

Sundaram Small Cap mildly underperformed, while Aditya Birla Sun Life Small Cap’s performance was relatively lacklustre.

Multi-caps taking root

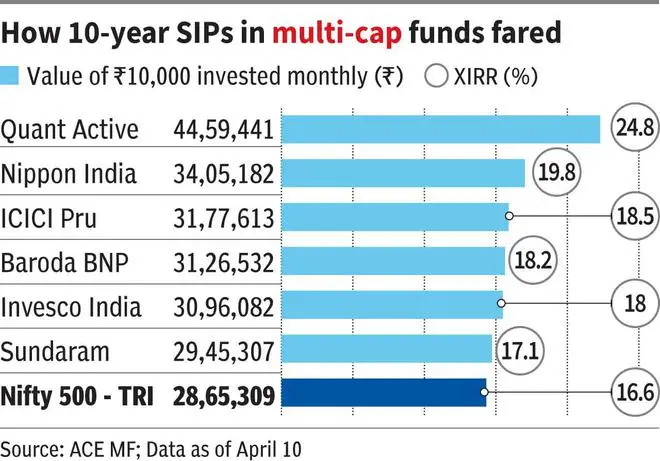

The category itself is only three years old, though many existing funds changed their mandate to make themselves multi-cap schemes. In the segment that has a SEBI mandate to invest 25 per cent of the portfolio each in large, mid and small-cap stocks, there are six funds with a 10-year track record and all six have managed to outperform the Nifty 500 TRI, which we set as the common benchmark.

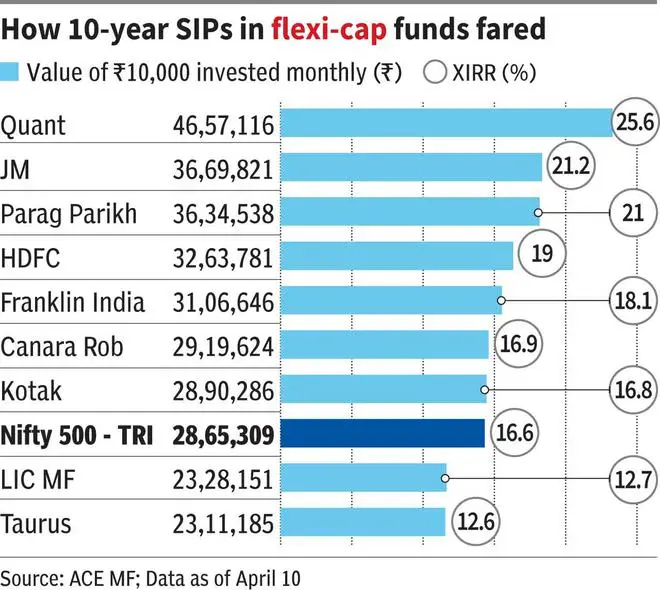

Flexi-caps on the ascent

This is a category that is quite popular among investors, thanks to the complete flexibility that the fund manager gets in deciding stock allocations across market caps.

Of the 16 funds that carry a 10-year record, eight managed to outperform the Nifty 500 TRI’s SIP returns over this period.

Quant Flexicap, Parag Parikh Flexi Cap, HDFC Flexi Cap, Franklin India Flexi Cap and JM Flexicap are some funds that have done well on the SIP front, beating the Nifty 500 TRI’s performance.

Taurus Flexi Cap, UTI Flexi Cap, LIC MF Flexi Cap and Bandhan Flexi Cap are among the underperformers.

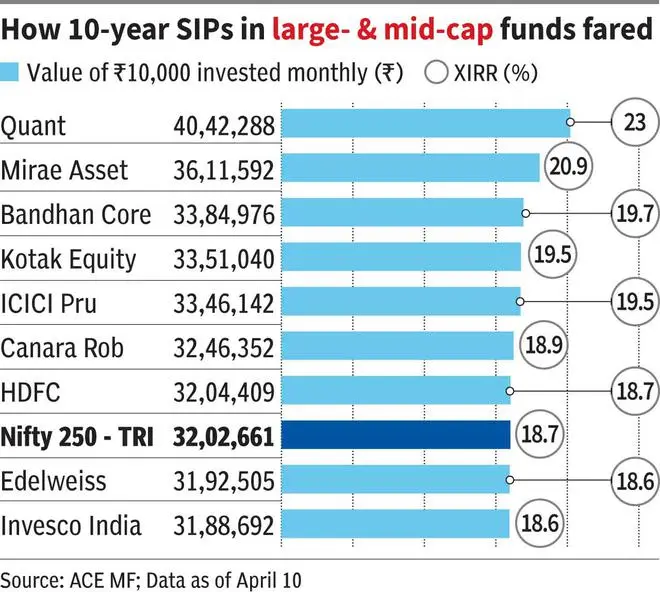

Large & mid-caps moderately positive

This category — with 18 funds that have been around for 10 or more years — saw seven funds outperform the SIP return of the Nifty Large Midcap 250 TRI, which was 18.66 per cent.

Quant Large & Midcap, Kotak Opportunities, Mirae Asset Large & Midcap and Bandhan Core Equity were among the best performers.

Aditya Birla Sun Life Equity Advantage, Nippon India Vision, Franklin India Equity Advantage and Bank of India Large & Midcap Equity were among those that lagged the benchmark in SIP returns.

Another round of filters

While SIP returns form one level of filter, to get to the best funds, we need another round of tests.

We set two barriers for final selection — the ones that made the cut with the SIP returns part were further put through two criteria.

One, mean five-year daily rolling returns of a fund over the past 10 years must be more than that of the corresponding benchmark – Nifty 100 TRI for large-cap schemes, for example. Some funds did well only in the post-Covid rally, while others recorded moderate performances in the same period. Some, however, did well across periods. Therefore, a five-year rolling return period is a good way to judge them.

Two, on a five-year rolling basis over the last 10 years, the fund must have beaten the benchmark at least 60 per cent of the time, so that we can safely assume that it is reasonably consistent.

One point to note here is that in some cases the SIP returns of funds may be among the top few. But when the rolling return test is taken, there are funds that tend to lose out.

Based on these criteria, we have chosen the funds to consider for SIPs from each category.

Best fund choices

Large-cap funds: There are many funds that crossed the 60 per cent consistency threshold. However, with a track record of beating the Nifty 100 TRI more than 75 per cent of the time, Mirae Asset Large Cap, ICICI Prudential Bluechip, Baroda BNP Paribas Large Cap, Canara Robeco Bluechip Equity and Edelweiss Large Cap are the best performers and can be considered for SIPs.

Mid-cap funds: This category is tricky when the rolling returns criteria are taken. When the five-year rolling returns over April 2014-April 2024 are taken, only one fund exceeds the mean returns of the Nifty Midcap 150 TRI. Again, with a score of exceeding the benchmark nearly 90 per cent of the time, Edelweiss Midcap fund alone makes the overall cut.

Although HDFC Midcap Opportunities and Motilal Oswal Midcap have delivered reasonable performance, they don’t measure up to our criteria.

Perhaps this space is better played via the index fund route or via Large & Mid-cap, flexi and multi-cap schemes.

Small-cap funds: When the mean five-year rolling returns over a 10-year period exceeding the Nifty Small Cap 250 TRI and consistently beating the benchmark at least 60 per cent of the time are taken into account, we get five funds that can be considered for SIP investments.

Axis Small Cap, Nippon Small Cap and SBI Small Cap are the best of the lot and they have outperformed the Nifty Small Cap 250 TRI 100 per cent of the time. HDFC Small Cap and Kotak Small Cap are reasonably good choices with outperformance for around 80 per cent and 87 per cent of the time.

Multi-cap funds: With only six funds in the category that have a track record of 10 or more years, only five schemes made the cut on exceeding the mean rolling returns of the Nifty 500 TRI. Of course, as a category itself, multi-cap funds are relatively new.

Quant Active, which outperforms all the time, and Invesco India Multicap and ICICI Multicap with 64-65 per cent outperformance, satisfy all criteria and can be considered for long-term SIPs. These funds were called differently until the category came about three-odd years ago and have somewhat realigned their mandates.

Flexi-cap funds: Of the eight funds that passed the SIP criteria and were put to the rolling return tests, five have managed to come out victorious.

Parag Parikh Flexi Cap and Quant Flexicap are the best in the category. Additionally, JM Flexicap, Canara Robeco Flexi cap and Kotak Flexicap are the three funds that pass all criteria set and are suitable for SIP investments.

Large & Mid-cap Funds: Among the seven funds that got past the 10-year SIP return criteria, only four managed to managed to beat the mean five-year rolling returns of the Nifty Large Midcap 250 TRI from April 2014 to April 2024.

These four funds also easily passed beat the benchmark more than 75 per cent of the time. Mirae Asset Large & Midcap, Kotak Equity Opportunities, Canara Robeco Emerging Equities and Quant Large & Midcap are funds that can be considered for long-term SIPs.

For investors, there may be a few funds that have sound a track record even outside the list.

But based on our criteria of SIP and rolling returns, the list mentioned under each category is a healthy basket of funds.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.