A recent report by Goldman Sachs provides insights on household savings patterns in India. The report highlights that while bank deposits continue to constitute the largest portion of household financial savings, it has been declining over the past two decades.

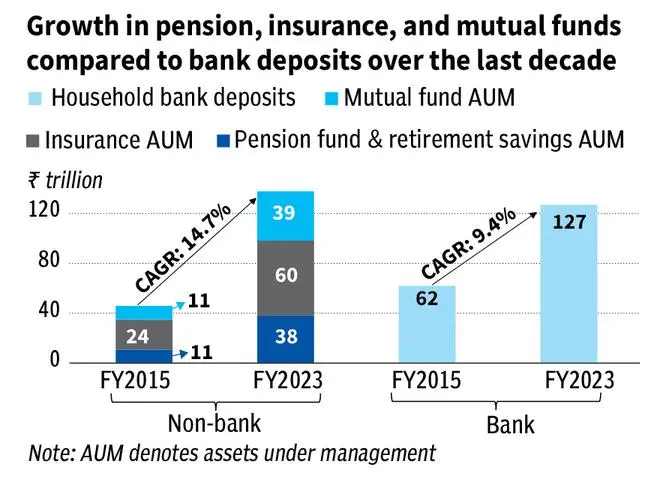

Conversely, retirement saving, insurance, and mutual fund assets have experienced a more rapid growth owing to financial literacy, government initiatives aimed at digitalization, and the broader formalization of the economy.

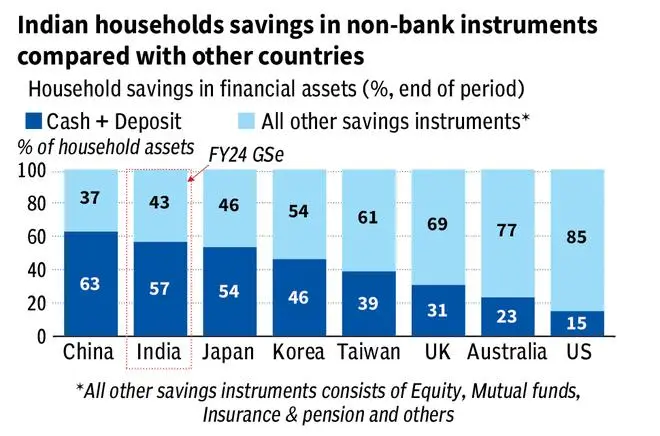

Despite these advancements, the allocation of Indian household savings to non-bank instruments remains lower compared to developed markets.

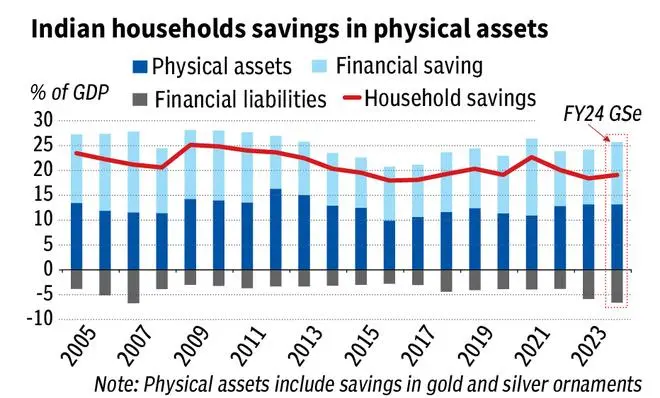

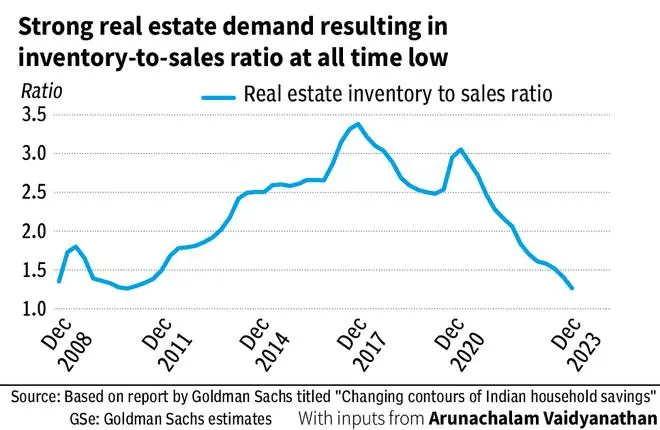

Furthermore, Indian households have historically favoured physical assets, particularly real estate which have consistently surpassed those in financial assets.

With inputs from Arunachalam Vaidyanathan

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.