Even as the election results led to the formation of a coalition government as against the expectation of full majority, markets have bounced back strongly after the crash on counting day. Even as indices move to fresh highs, valuations continue to be uncomfortable.

One way to play it safe in the current environment is to bet on companies with stable cashflows and relatively low debt. Thus, the dividend yield theme becomes attractive as an investment option. Companies usually become reasonably consistent and high dividend yielding once they become mature, and these are available across market caps though they are more prevalent in the large cap space. This theme may underperform at times, especially when growth stocks are on in market favour.

However, as a long-term strategy, dividend yield can be rewarding with relatively lower level of volatility in the portfolio as such funds invest in stocks that generate regular cashflows.

In this regard, investors can consider the HDFC Dividend Yield fund for a timeframe of 7-10 years. The fund was launched in December 2020 and has done quite well over the past few years, as seen by its ability to beat the benchmark (Nifty 500 TRI) convincingly and deliver above-average returns.

Investors can use the SIP route for taking exposure to the fund to average costs.

Above-average performance

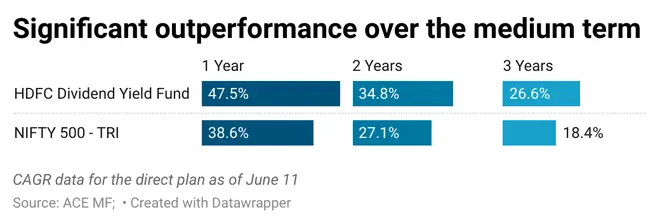

HDFC Dividend Yield fund has delivered 7-9 percentage points more than the Nifty 500 TRI over one, two and three-year timeframes on a point-to-point basis. The scheme’s three-year CAGR of 26.6 per cent is among the best in the category and even among many other equity categories.

On a rolling one-year basis over December 2020 to June 2024, HDFC Dividend Yield has delivered an average return of 24.8 per cent annually, compared to 15.8 per cent for the Nifty 500 TRI over the same period.

- Also read: Elections, coalition government and stock markets: Best thematic mutual funds for your portfolio now

Again, one one-year rolling returns over the same timeframe, the fund has beaten the benchmark all the time (100 per cent).

If SIP returns (XIRR) are considered over the past three years, the fund has given a robust 30.6 per cent in this timeframe. An SIP in the Nifty 500 would have managed 23.4 per cent over the same timeframe.

These data points clearly indicate that the fund has delivered a fairly consistent performance in the limited period since it was rolled out.

The fund has an upside capture ratio of 108 – based on data over the past three years (2021-2024) – indicating that its NAV rises much more than the benchmark Nifty 500 TRI during rallies. But more importantly, its downside capture ratio is only 74.1, suggesting that the fund’s NAV falls a lot less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark.

Prudent portfolio moves

The fund takes a multi-cap approach to selecting stocks in its portfolio. Large cap stocks typically account for 65-68 per cent of the holdings across timeframes, given that a good part of dividend paying companies come from this segment. Small caps account for 15-20 per cent of the portfolio, which has helped the fund deliver healthy returns given the rally in this market cap segment. The mid-cap part makes up 8-15 per cent.

HDFC Dividend Yield takes a diffused approach to portfolio construction with even the top stock holdings accounting for less than five per cent of the holdings, barring a couple of names.

In terms of sector preferences, IT Software and banks have always been the top holdings of the fund. These segments haven’t delivered much in recent years, but still have a fair degree of valuation comfort.

The fund has reduced stakes in the underperforming diversified FMCG segment over the past year or so. It has increased investments in sectors that have done well in recent years such as power, automobiles and construction.

HDFC Dividend Yield remains invested across timelines and takes cash positions of only 2-3 per cent.

Overall, the fund is suitable for investors with a moderate and reasonable risk appetite.

Investors can consider taking exposure to the fund as a part of their satellite portfolio. Investments via the SIP mode with a time horizon of 7-10 years could be rewarding for investors as that would ensure purchases across market levels and cycles.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.