Prices of lithium, a critical metal used in batteries of electric vehicles (EVs), will likely rule below the highs seen in 2022-23 as its supplies have increased leading to a surplus in the market, analysts say.

The critical metal prices have dropped by over 5 per cent since the beginning of 2024. Currently, battery-grade lithium carbonate prices are ruling at 91,323 Chinese yuan ($12,574.42) a tonne and rates of lithium hydroxide — also battery-grade — at 83,030 yuan ($11,432.54) a tonne.

Down 70% y-o-y

Lithium prices, which are down 70 per cent year-on-year, had soared to 0.575 million yuan ($79,000) a tonne in December 2022. Lithium carbonate and lithium hydroxide are refined lithium products.

Research agency BMI, a unit of Fitch Solutions, said in 2024-2025 lithium prices are expected to remain below 2022-2023 highs, owing to a rapidly expanding global lithium supply that has pushed the lithium market into surplus. “We forecast Chinese lithium carbonate 99.5 per cent to average $15,500/tonne in 2024 and $20,000/tonne in 2025 (compared with $72,081/tonne in 2022 and $35,956/tonne in 2023), and for Chinese lithium hydroxide monohydrate 56.5 per cent to average $14,000/tonne in 2024 and $20,500/tonne in 2025 (compared to $69,496/tonne in 2022 and $38,324/tonne in 2023),” said BMI in its outlook.

Subdued Chinese activity

The World Bank, in its Commodity Outlook, said lithium prices tumbled by 18 per cent quarter-on-quarter. “Price declines were driven partly by weak demand, particularly for EVs, and subdued activity in China, but also by a continued ramp-up of supply anticipating prospective needs for the energy transition,” it said.

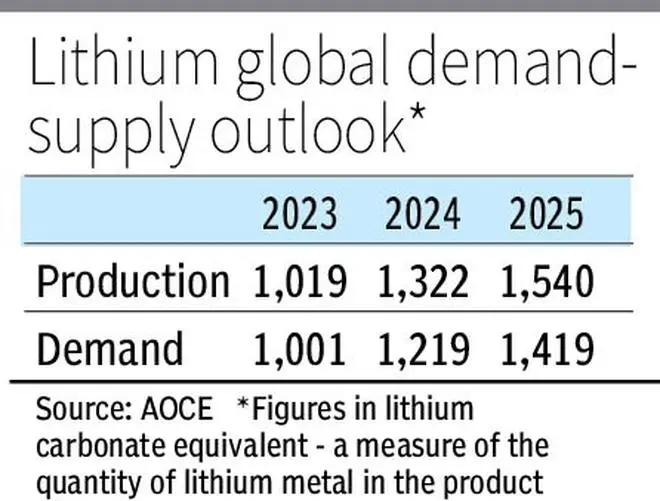

The Australian Office of the Chief Economist (AOCE) said lithium prices will likely stabilise as high-cost producers exit the market. Making its prices forecast for years ahead, it said the forecasts have a high degree of uncertainty “as new producers enter the market around the world and uneven trends in EV demand growth”.

Lithium prices could respond to unexpected developments in the pace of EV adoption and other emerging uses, changes in battery technology and government policy, over the outlook period (to 2028), the AOCE said. “The fall in prices over 2023 has driven a reduction in production (particularly by some high-cost producers). This is likely to support a modest recovery in lithium prices over 2024 and 2025,” it said.

Projects in pipeline

The International Energy Agency (IEA) said from Africa to Indonesia and China, the ramp-up of new supply outpaced demand growth over the past two years. “Together with an inventory overhang in the downstream sector (e.g. battery cells, cathodes) and a correction of overly steep price rises in 2021-2022, this produced downward pressure on prices,” it said.

BMI said a significant rise in lithium production in 2023, spurred by previously elevated prices, along with weaker-than-expected demand, pushed the market into surplus. Prices declined throughout 2023, returning to levels seen before the 2021 upswing.

The AOCE said global lithium supply is projected to broadly keep pace with rising demand, with sizeable project pipelines among large producers (such as Australia and China) as well as among new and emerging producers (such as Argentina and Zimbabwe).

BMI concurred with the view that the increase in lithium supply, driven by these producers, is likely to cap further price growth, with the lithium market forecast to remain in surplus over 2024-2025. It said demand for lithium chemicals for use in EV batteries will be elevated, though.

Long term prospects

Xuan-Ce Wang, Managing Director, Chief Scientist and Professor at Mineral System and Geology, wrote on Linkedin that the second quarter of 2024 has seen significant strategic movements and investments in the lithium market, with varying degrees of progress across different regions. While some projects face challenges, others are on track for increased production and capacity expansion, he said.

IEA said the anticipated mine supply from announced projects will meet only 50 per cent of lithium requirements.

In the longer term, lithium prices are likely to be impacted by innovations in battery chemistries, including the adoption of batteries either without lithium or those that require a reduced amount of lithium, said BMI.

- Also read: Crude oil down as US inventories increase

AOCE concurred that from 2026, alternate battery chemistries could put pressure on lithium-ion EV batteries, resulting in a fall in lithium prices for the rest of the outlook period.

Additionally, faster-than-anticipated advancement in battery recycling technology presents downside risks to lithium prices by significantly expanding the sustainable lithium supply, BMI said.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.