Oracle Financial Services (OFSS) has been in the news in recent weeks after posting strong Q3 results, post which the stock moved up by around 40 per cent in two days. The company surprised significantly on the upside in its Q3 results across the board — revenue, margins and deal wins, reflecting structural strength in underlying business.

Since our buy reco on the stock in bl.portfolio edition dated October 2, 2022, the stock of OFSS is up by 118 per cent to ₹6,521. However, with valuations still not excessive at one-year forward PE of 23 times now, and underlying momentum showing acceleration with 3Q results, existing investors can continue to hold the stock. Decent dividend yield even after increase in share price at 3.4 per cent, which can be sustained by strong balance sheet with net cash at 8 per cent of market capitalisation and FY25 estimated free cash flow yield (fcf/market cap) at 4 per cent, is an incremental positive.

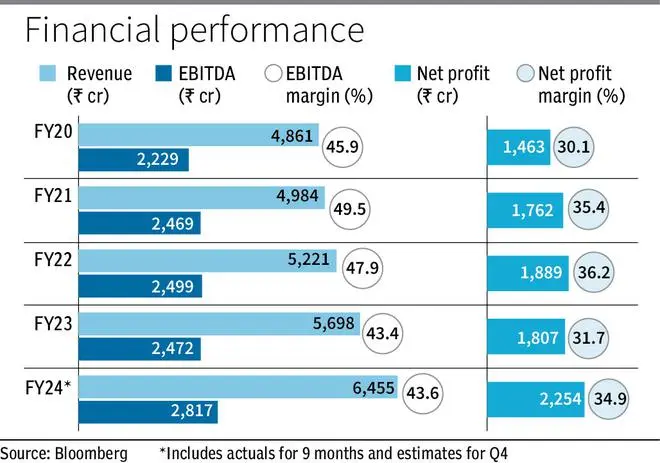

Although OFSS is not comparable with IT services peers, given it’s a products company, it will be worth noting that its FY19-24 (E) EPS CAGR at 10 per cent is comparable with large IT services players (TCS, Infosys, Wipro and HCL Tech) which have growth EPS in the 9-13 per cent range in the same time period. OFSS being a products company has superior EBIT margins at 42-44 per cent, versus EBIT margins for tier-1 IT service players ranging 16-24 per cent, varying across companies.

Business

OFSS is a global leader in providing IT solutions to the financial services industry. It offers comprehensive banking applications across the spectrum of retail, corporate and investment banking to financial institutions. Its technology solutions include core banking technology and cover end-to-end requirements (front to back office) in the financial services industry and also include risk management, analytics and forensic finance.

It is a software products company and earns revenue by way of licensing, consulting and maintenance fees linked to the product. Its flagship product is Oracle Flexcube. The company also earns some revenue from allied services and BPO. However, these currently form a small part, with products revenue accounting for 90 per cent of total revenue. Within its products business, the company has been adapting well to the changing dynamics in the industry with the shift towards SaaS (software as a service). It has been making investments in this space and a large portion of its banking product portfolio is now available as a cloud service.

OFSS is geographically well-diversified with around 25 per cent of revenues from the US, 15 per cent from Europe, 25 per cent from APAC, 16-17 per cent from the Middle East and Africa, around 11 per cent from India and balance from rest of the world. Typically in the Indian IT space, the US and Europe account for 80-90 per cent of revenues for many companies. OFSS’s much lower exposure to these geographies and healthy diversified geographic mix is working to its advantage now as slowdown risks loom in these two major geographies.

Recent performance

In the recently reported Q3 FY24 results, OFSS posted 25 per cent USD Y-o-Y revenue growth and 26 revenue per cent growth in INR terms to ₹1,823.6 crore. This reflected a solid rebound after growth had turned flattish in previous two quarters. The results were driven by strong underlying momentum with licence wins at $49.5 million, up by 80 per cent Y-o-Y. Deals were won across traditional on-premise deployments as well as its cloud/SaaS offerings. According to management, deal pipeline remains robust across regions.

EBIT in Q3 was up by 45 per cent Y-o-Y to ₹849.6 crore, with EBIT margins strong at 46.5 per cent (40.4 per cent in Q3FY23). Net profit was up 69 per cent to ₹740.8 crore.

Following the results, the shares have seen a re-rating with trailing one-year forward PE expanding from 16-17 times a few months back to 23 times now. Given the quality of earnings beat and strong momentum, the re-rating can sustain, although there can be fluctuations on and off.

As for peers operating in similar field, Intellect Design Arena trades at one-year forward PE of 27.7 times, while Swiss company Temenos trades at 28.7 times.

US software giant Oracle Corporation owns 73 per cent stake in OFSS. On and off, the lack of clarity on what Oracle plans to do with its stake has weighed on the valuations of OFSS, but for a long-term investor, when valuations have compressed on this or other concerns, it has actually turned out to be a good buying opportunity as recent share performance has shown.

One risk the company faces is of customer concentration, with largest customer accounting for 48 per cent of revenue and top five customers accounting for 66 per cent of revenue. While a risk to be monitored, this does not appear to have caused any disruptions so far.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.