Driven by the robust Q3 economic growth, Nifty climbing its way towards 22,500 was no big surprise. With positive momentum continuing through last week, the index crossed 22,500. It ended the day just shy of 22,500; at an all-time closing high of 22,493.5. After rebounding past the 20,000-mark last year September, Nifty took 121 trading sessions to reach the 22.5K milestone. In this record journey, it would be interesting to note that the best-performing stocks may not necessarily have been the drivers, given the index’s free-float market cap. Here’s a detailed analysis to discern the primary contributors to this upward trajectory based on their respective weights.

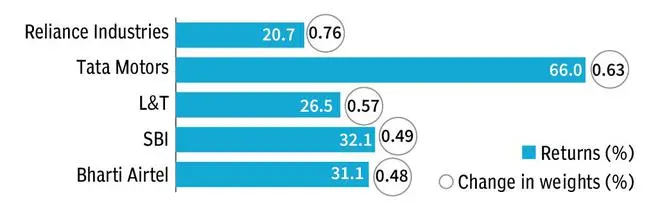

Reliance Industries, first Indian company to cross ₹20 lakh crore market cap, has been the biggest contributor to the Nifty’s upside. Its weight in the index has increased by around 76 bps now.

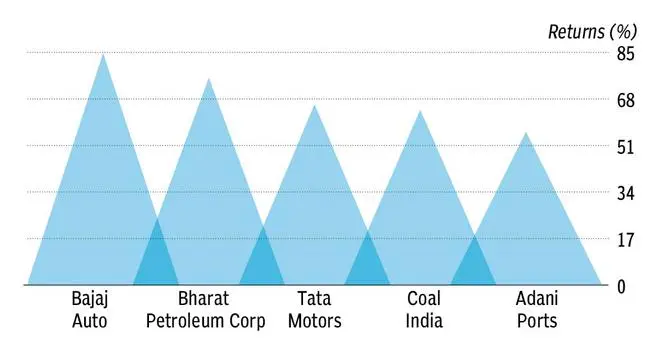

In terms of absolute performance, Bajaj Auto was the biggest performing stock though it was not the biggest driver of the index in this journey. The respective increase in weights for the top five gainers were 44 bps, 22 bps, 63 bps, 37 bps, and 31 bps.

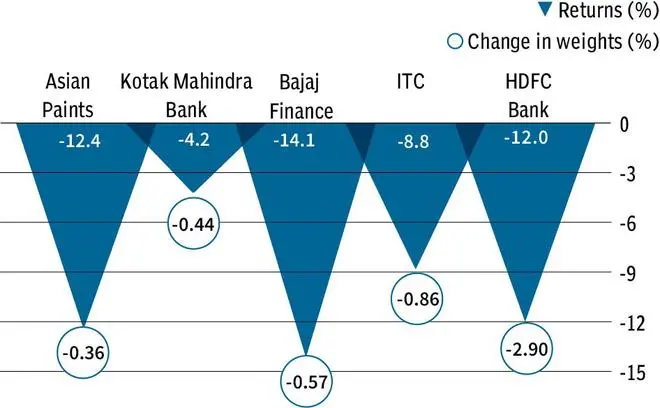

HDFC Bank stood out as a laggard with the highest drop in its weightage.

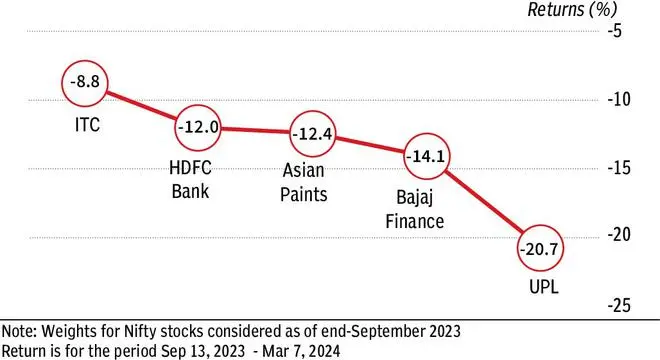

In terms of absolute stock returns, UPL was the worst performer on account of poor Q3FY24 performance though it did not see the maximum reduction in weights.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.